Our Journey to Financial Freedom

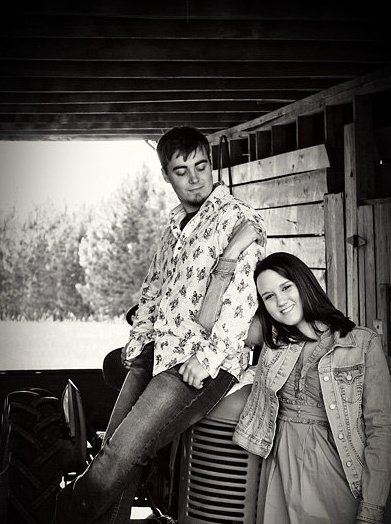

Let me start by saying that even though I have a degree in financial management, I am not a professional financial advisor. I’m sharing what worked best for Cory and myself using the Dave Ramsey program. We are not affiliated with Dave Ramsey nor are we paid by him. We are just avid followers who want to share our success story.

It all started in January of 2012 with a living room suite. The worst decision we’ve {as a married couple} made to date led to the best decision lifestyle change we’ve made.

Cory and I had been in our house for over a year and we had this green and red plaid sectional that my grandparents gave us. Even though it was comfy, it didn’t match the decor of our house. I had been looking for months and finally found a set I liked that wasn’t too outrageously expensive. It was one of those deals where if we bought the whole living room set {coffee tables, lamps, etc} they would throw in a TV and 0% financing for XX months.

The TV is what sold Cory and the 0% financing sold me.

While standing in the store, we told ourselves that whatever we got back from our taxes would go straight to the furniture.

Two problems with this theory: 1) We didn’t know how much we were getting back on our taxes since we hadn’t filed them yet. We were estimating {bad idea} how much we would get back based on what we had gotten back for 2010. 2) 2010 was the first year we were married, we bought a house and we only had half a year of Cory’s salary because he started his job in June. 2011 was a full year salary for Cory {higher tax bracket} and I had a 401k that I rolled into a Roth IRA when I changed jobs.

I’m going to be a little financial for a second and explain that a 401k is deducted before taxation meaning you don’t pay taxes on the money you put into it until withdrawn during retirement. This helps lower your taxable income when it comes tax time. A Roth IRA has a future tax break meaning there is no up front tax deductions for your contributions but offers tax free income during retirement. Unlike the 401k, the Roth IRA doesn’t help lower your taxable income.

With that being said, our taxable income in 2011 was much higher than in 2010. With higher income comes higher taxes. Even though we knew the tax implications for the Roth IRA, we didn’t expect to be pushed up two tax brackets from the year before. Not only were we not getting money back for our taxes, we owed the government!

I remember walking out of our accountants’ office and literally felt sick to my stomach. How did we accumulate almost $7,000 in debt in a few months?

Something had to change.

So, we started looking into Financial Peace University (FPU) by Dave Ramsey. We had some friends who had completed the class and they let us borrow their DVDs. We got online and ordered the workbooks and the envelope system to go with it.

Please understand that this program is for everyone. A lot of the success stories we read were from people who had serious debt. Hundreds of thousands of dollars, on the verge of losing their house kind of debt. Fortunately, Cory and I were not in that situation. When we started this program, other than our house, we owed around $10,000. I know this number may not seem big to some people, but it was more than we felt comfortable with and we had accumulated it so quickly. We could see the path we were headed on and it scared the living heck out of us.

One of the first things you do in FPU is make a budget {after cutting up your credit cards, of course}. Even though I am a numbers kind of girl, I really dreaded doing a budget. I like to spend money and didn’t want to be tied down with my spending. If it weren’t for Cory completing our first budget, we wouldn’t be where we are today.

The thing about doing a budget is you can put the money wherever you want it, as long as it all has a place to go. Soon after creating our budget, I realized how much money I wasted. In order to curb our spending, we use the envelope cash system. Once the money is gone from that envelope, you stop spending.Easy, right?

Ahem.

I’m not gonna lie, the principal is easy but the practice is hard. The whole programs takes discipline and communication and it caused some nasty arguments. Arguments over money are the worst because defenses come up and in our case some not so nice words were exchanged.

But month by month, it got easier. We figured out how to talk about money without it turning into an argument, and about what works best for our budget. Sure enough, we started to have money left over each month.

FPU has baby steps that you follow and where your extra money goes depends on which step you are on. As of February, we are on baby step 3, meaning that we have paid off all our debt {other than our house} and are working on building up our emergency fund.

One thing we love about FPU is you can set your own pace and goals. Cory and I weren’t in a dire situation to get out of debt so our pace was probably slower than others. Dave recommends that you don’t put any money towards savings until you reach a certain point in the journey, allowing all extra money to go towards your debt. However, we have a few retirement accounts that are automatically drafted, so we left those alone. This program is all about doing what works best for you and your financial situation as long as you are controlling your money.

Honestly, I don’t know how we ever lived without a budget. Yes, it sometimes get tedious because I have to adjust ours weekly to allow for changes in Cory’s paycheck, but it has become second nature to us. We still have our moments when we want instant gratification but if we don’t have the money for it, we don’t buy it. It is much more satisfying to save your money and buy when you can afford it. Plus, you don’t have buyer’s remorse afterwards!

I am thankful everyday for making that bad decision and buying the living room furniture because of the lifestyle change it led to. Even though we have had to make small sacrifices over the past year and a half, our lives are so much more enjoyable.

I understand that finances are a sensitive subject to discuss but I wanted to share our journey in hopes that it might help someone else. I will be happy to answer any questions about our journey but I encourage you to check out Dave Ramsey’s Financial Peace University if you want to learn to control your money or if you’re struggling with debt.

One Comment

Pingback: